58% of employees are one pay check away from trouble

Being one pay check away from financial difficulty is not an abstract statistic. It highlights a level of financial fragility that many UK employers are managing within their workforce, often without full visibility of the risk.

Hywel Phillips, Chief Operating Officer at Personal GroupTuesday 11 February 2025

Share on socials:

Research shows that a significant proportion of employees would struggle to cope with an unexpected reduction in income. This is rarely about poor financial decisions. It is usually about limited financial resilience when illness, injury, or time away from work interrupts pay.

For employers, this matters because financial pressure does not stay outside the workplace. It affects wellbeing, focus, absence, and engagement, particularly for lower-paid employees and new starters.

The reality behind “just getting by”

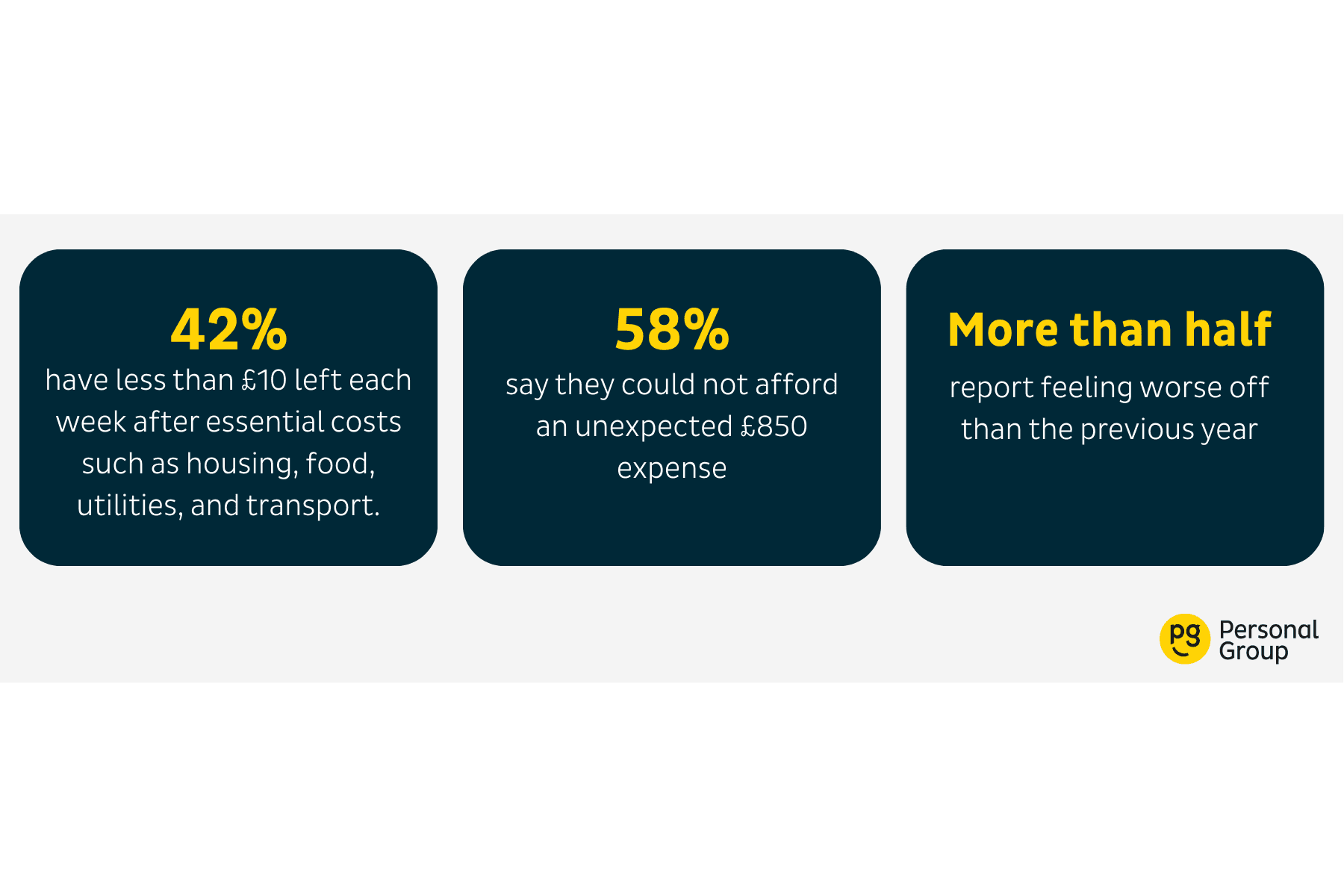

Research from the Living Wage Foundation shows the scale of financial insecurity across the UK workforce.

Among employees earning below the Real Living Wage:

An £850 shortfall may sound manageable to some, but for someone earning the National Living Wage it represents just over two weeks’ pay. For employees without savings, it can quickly create financial strain.

For employers, this level of fragility increases the risk that everyday life events translate into stress, distraction, and disengagement at work.

When illness or injury becomes a financial shock

Unexpected costs are often triggered by events outside an employee’s control. Illness or injury can mean time away from work, reduced hours, or reliance on statutory sick pay, which may not cover basic living costs.

This risk can be more pronounced during the early stages of employment. Research from CIPD shows that enhanced sick pay is not universally available across UK organisations, and where it is offered, eligibility often depends on length of service. As a result, some employees may rely solely on statutory sick pay during their first months in a role, which can lead to a temporary reduction in income if they need time away from work.

When income falls, essential costs remain:

- Rent or mortgage payments continue

- Energy bills still arrive

- Food, travel, and childcare costs do not reduce

For employees with little financial buffer, this can quickly create pressure. For employers, it increases the likelihood of presenteeism, absence, and wellbeing issues that affect performance.

Financial pressure does not stop at the payslip

The Living Wage Foundation research also highlights how financial insecurity affects employees’ wellbeing:

- 67% say their pay negatively impacts their mental health

- 67% experience increased anxiety due to financial worries

- 65% report disrupted sleep

- 53% say money worries strain their relationships

These impacts do not remain at home. Financial stress often shows up at work through reduced concentration, higher absence, and lower engagement, all of which carry operational and people-related costs for employers.

Why protection matters, especially in the first year

This is where access to workplace protection can play a role. Employee insurance and healthcare cash plans do not replace income. Instead, they can help employees manage some of the additional costs associated with illness or injury, such as treatment-related expenses, during periods when income may be reduced.

In that context, protection can form part of a broader financial wellbeing approach, helping to reduce pressure at a time when employees may be relying on statutory sick pay or reduced earnings.

For employees, access to protection can provide:

- Additional reassurance alongside statutory or employer sick pay arrangements.

- Support with certain health-related costs during periods of illness or injury

- Greater financial predictability when managing unexpected health expenses

For employers, offering access to protection through the workplace can:

- Help employees manage health-related costs during absence

- Support wellbeing without committing to enhanced sick pay structures

- Complement existing financial wellbeing and benefits strategies

Hearing it directly from employees

This is not a theoretical issue. It is something Personal Group’s Employee Engagement Executives encounter regularly.

Hywel Phillips, Chief Operating Officer at Personal Group, explains:

Hywel Phillips, Chief Operating Officer at Personal Group“Our Employee Engagement Executives often speak with employees who are acutely aware of how illness or injury could affect their finances, particularly new starters who do not yet have sick pay. When we explain how workplace insurance works and the support it can offer if they are unable to work, employees value the clarity. It helps them feel more informed and reassured at a time when they may be financially exposed.”

This insight reflects the importance of clear communication and access to support, rather than assumptions about employee resilience.

Questions employees often need help answering

Employees do not always have a clear view of how illness or injury could affect their finances. Common questions include:

- How would my income be affected if I had to take time off work due to illness or injury?

- What support is available to help with costs if I am relying on statutory sick pay or reduced earnings?

- Do the benefits offered through my employer help with health-related expenses?

For employers, ensuring employees can easily find clear answers to these questions is an important part of supporting financial wellbeing and reducing uncertainty.

Moving from awareness to action

Being one pay check away from financial difficulty is a reality for many employees. While employers cannot control the cost of living, they can take steps to reduce financial risk within their workforce.

Providing access to employee insurance and healthcare cash plans is one practical way to support financial resilience, particularly for new starters and employees with limited financial buffers.

Protection is not about policies alone. It is about enabling employees to recover, remain engaged, and return to work without added financial pressure when life does not go to plan.

Find out more

To explore how workplace protection can support your workforce and complement your existing benefits strategy, find out more at hapi.co.uk/pg-insurance

Sources

Source

Living Wage Foundation, UK Living Wage and In-Work Poverty Research, 2023.

Figures based on UK employees’ ability to meet unexpected costs and manage essential household expenditure.

Chartered Institute of Personnel and Development (CIPD), Health and wellbeing at work survey, 2023.

The research highlights variation in employer sick pay provision across UK organisations, with eligibility for enhanced sick pay often linked to length of service, meaning some employees rely solely on statutory sick pay during early employment.

Important information

This article is for information only and does not constitute financial advice. Any insurance product suitability depends on your organisation’s needs, employees’ individual needs for employee paid plans and the terms of the relevant policy.